There’s no easier way to keep up with family and friends than by using social media. It’s also great for tracking the latest news or even finding new homes for pets or used items for sale.

The popularity makes it a great place to find anything and everything. Unfortunately, scammers know that, too.

“Fraudsters leverage social media platforms to troll for potential victims, carry out scams and obtain personal information,” said Jeff Taylor, head of commercial fraud forensics at Regions Bank. “It’s unfortunate that platforms intended for good are being used for nefarious purposes, but it results in the need for even more caution about what you post and who you interact with.”

Here are some of the most common social media scams:

Social Media Code Verification Scam

The skinny – According to Scott Augenbaum, a cybercrime prevention trainer and retired FBI agent, scammers compromise accounts and then then reach out to the victim’s contacts, asking for assistance with a verification code, which is actually a ploy to hijack your account.

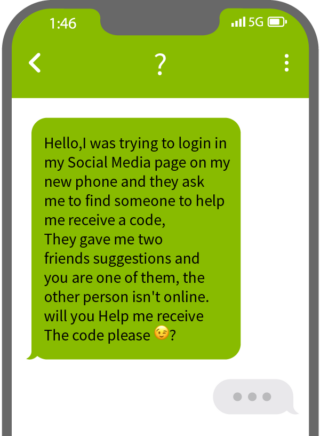

What you should look for – A message like this:

Your next step – Keep your codes secret and never share with a third-party (even friends). If you receive a request from a friend, verify independently (phones work for a reason). Finally, if it looks like a scam report it. That helps keep other safe and reduces the threat of a cyber threat.

Social Media Marketplace Scams

The skinny – It’s a popular place to buy and sell because popular sites offer easy access and don’t charge a fee. Because of the anonymity and numbers, however, it’s also a popular place for scammers.

What you should look for – There are plenty of red flags, as detailed in this Business Insider story. For instance, you’re asked to send the item before you receive payment. In other cases, someone may overpay then ask for a refund. You’ll likely find out that the original check bounced, so you lose money twice if you refund. In another scam, the seller asks you to move the conversation to text, then sends a code to “prove you are for real.” This is just a method used to set up a fake account using your number. Don’t respond.

Your next step – When you recognize the red flags, stop the conversation. And if you do need to meet someone in person, pick a public place and bring a friend. In many towns, local law enforcement provide designated meet-up spots – including the local police station – to help guarantee safety.

“Remember,” Taylor said, “if it looks to good to be true, it probably isn’t legitimate.”

Fake Job Sites

The skinny – Job sites make the effort to verify new postings, yet some fake ones fall through the cracks. More often, imposters use social media to pose as legitimate hiring firms or contact you through email claiming to be a job recruiter. Another common tactic is to set up an interview through an online messaging service. And everyone is familiar with the mystery shopper and work-from-home offers. While some are legit, fraudulent ones ask for payments up front.

What you should look for – Unnecessary calls after initial contact, unprofessional emails and websites that provide scant information are all good signs that something is amiss.

Your next step – Do your research before replying, including doing a search of the company followed by “scam,” “fraud” or “review” that will bring up bad news quickly. Look for the http:// to verify a website. Most of all, trust your gut and protect your personal information.

Fake Followers/Fake Accounts

The skinny – An old friend sends an invite to connect on social media. Or people you’ve never heard of before ask to connect out of the blue. This one is one of the most prevalent social media scams.

What you should look for – If it’s a really good friend, odds are you’ve already got a connection, and this is an imposter. An easy check is to go to their page and if information is scarce, be very wary. Likewise, someone follows you hoping you’ll follow them back and then they can gain your trust. We personally know of a “relative” on LinkedIn who recently started messaging about a can’t-miss scheme to make money fast. When we reached out to the relative, they confirmed the account was fake.

Your next step – Don’t accept the friend. And when you have followers you don’t recognize, remove them or at least limit what they can see on your page.

Trolling for Data

The skinny – It’s all about identity theft. Scams can range from imposters posing as banks, utilities or major companies seeking to verify your personal information to phishing emails with links that leave malware on your devices.

What you should look for – A bill or invoice for something you didn’t pay for, contact from a debt collector about a debt you don’t have, or a notice that your data has been compromised and you need to provide personal information to protect yourself going forward. Remember, as we often say, #BanksNeverAskThat.

Your next step – Keep security features on your devices updated. Use complicated passwords or pass phrases, and don’t use the same password across multiple platforms. Set up accounts online so you can verify when you get a notification. Shread old paper statements. And, when asked for information out of the blue, don’t respond.

Fake Charities or Donation Requests

The skinny – We all want to help, but scammers use our empathy against us with schemes that often center around veterans, first responders or disaster victims, according to AARP.

What you should look for – The first warning sign is pressure to respond immediately. Another is a request for a gift card, wire transfer, cryptocurrency payment or transfer to a crypto wallet. Those are scammers’ delights because they are hard to trace. A third red flag is a thank-you note when you don’t remember making a donation. The idea is to make you believe you’ve donated before, so why not again?

Your next step – AARP suggests going to trusty watchdogs ( or CharityNavigator) to verify. The BBB suggests using Wise Giving Alliance to confirm a charity’s track record. A third suggestion is to contact your state’s charity regulator to determine dependability.

Related Articles From Doing More Today:

The information presented is general in nature and should not be considered, legal, accounting or tax advice. Regions reminds its customers that they should be vigilant about fraud and security and that they are responsible for taking action to protect their computer systems. Fraud prevention requires a continuous review of your policies and practices, as the threat evolves daily. There is no guarantee that all fraudulent transactions will be prevented or that related financial losses will not occur. Visit regions.com/STOPFRAUD or speak with your Banker for further information on how you can help prevent fraud.