BIRMINGHAM, Ala. – Oct. 11, 2022 – Regions Bank on Tuesday announced the launch of a digital solution enabling Corporate Banking clients to send real-time payments through the RTP® network from The Clearing House. The new real-time payments service is part of Regions’ iTreasury platform, which offers a wide range of competitive financial management options for businesses through Regions’ Treasury Management division.

“This latest enhancement is part of our commitment to providing a seamless and intuitive customer experience,” said Bryan Ford, head of Treasury Management for Regions Bank. “Our team takes a holistic approach toward understanding the needs of businesses and delivering solutions that help companies improve their cash flow while cutting down on time-consuming processes and reducing their risk. The ability to send and settle digital payments within seconds will help our clients focus more of their time on efficiently managing successful companies while we provide an even deeper level of financial solutions.”

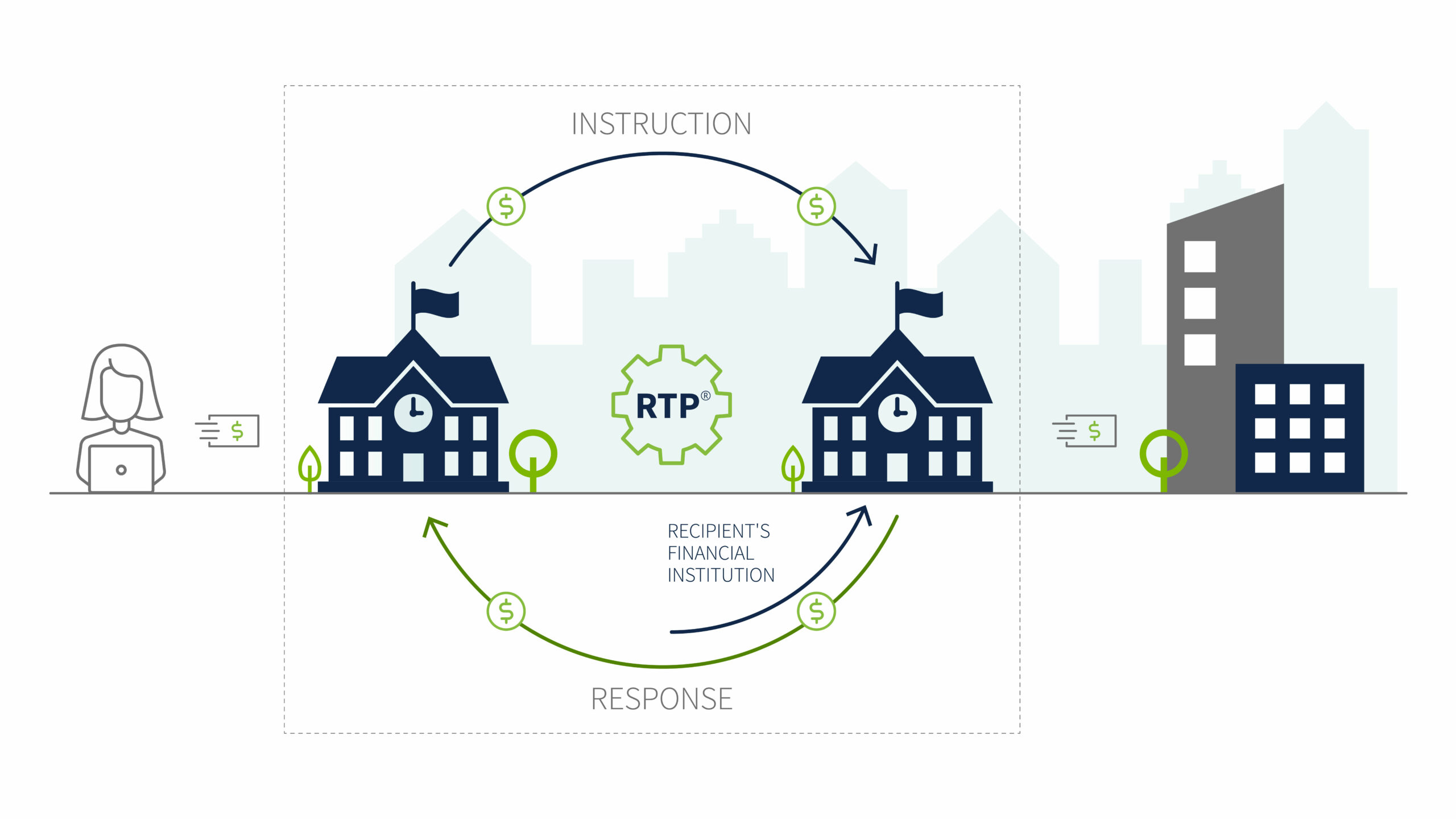

Currently, Treasury Management clients can receive payments in real time. Now, with the added ability to send payments in real time through Regions iTreasury®, clients can instantly process digital payments for any number of needs, ranging from payroll and insurance, to facilitating business-to-business payments, delivering broker commissions, and providing other disbursements. This brief video illustrates how the system works efficiently and effectively.

Clients access Regions iTreasury in their office or on the go through Regions OnePass®, the bank’s secure, central sign-on application. The ability to send real-time payments is one of many enhancements Regions has made over time to its Treasury Management services. Those enhancements extend beyond payments and include modernized file delivery methods, secure application programming interface (API) connections, and other emerging technologies.

Clients access Regions iTreasury in their office or on the go through Regions OnePass®, the bank’s secure, central sign-on application. The ability to send real-time payments is one of many enhancements Regions has made over time to its Treasury Management services. Those enhancements extend beyond payments and include modernized file delivery methods, secure application programming interface (API) connections, and other emerging technologies.

Further enhancements on the horizon for Regions’ Treasury Management clients include the upcoming launch of Regions CashFlowIQSM. This new tool, scheduled to launch in 2023, is designed to improve cash flow for clients by providing seamless accounts payable, accounts receivable, invoicing, and business bill payment capabilities for small and mid-sized businesses.

“We are driven by a mindset that’s focused on continuous improvement – consistently envisioning ways we can deliver greater value through tailored services, insights, and guidance,” Ford concluded. “In many ways, our team serves as an extension of our clients’ teams by connecting businesses with options to help them maximize efficiency. Sending payments in real time is the latest example, and we look forward to delivering even more enhanced solutions in the near future.”

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with $161 billion in assets, is a member of the S&P 500 Index and is one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services. Regions serves customers across the South, Midwest and Texas, and through its subsidiary, Regions Bank, operates approximately 1,300 banking offices and more than 2,000 ATMs. Regions Bank is an Equal Housing Lender and Member FDIC. Additional information about Regions and its full line of products and services can be found at www.regions.com.