BIRMINGHAM, Ala. – Oct. 12, 2021 – Regions Bank on Tuesday announced the results of a new retirement survey that finds many Americans need help getting on track with savings to retire comfortably. The survey was conducted by Regions Next Step, the bank’s free financial education program.

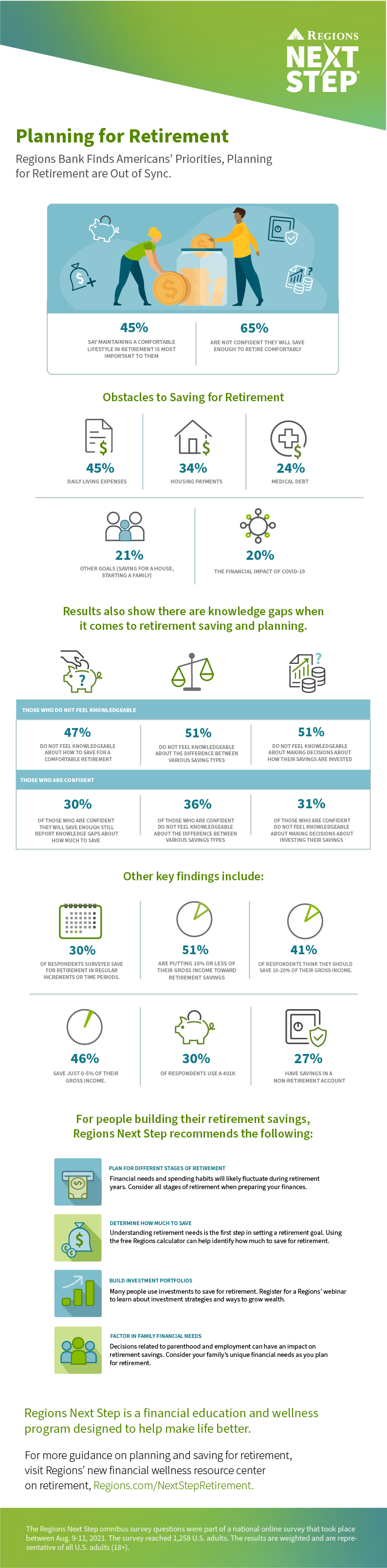

According to the survey, Americans’ top priority for retirement is maintaining a comfortable lifestyle, with just under half of respondents (45%) saying it is most important to them when thinking about their retirement goals. However, 65% of respondents are not confident they will save enough to retire comfortably. That confidence varies by gender, with 39% of men feeling somewhat or very confident compared with 31% of women. Confidence also varies by income, with only 20% of respondents who make under $40,000 annually reflecting confidence in their savings plans – and 32% who make between $40,000 and $80,000 reflecting confidence.

“While this survey highlights a gap between what people want from retirement and how they are planning for it, there is good news in that free financial resources are available to help people plan for the future, no matter how much or how little they have saved so far,” said Scott Peters, head of the Consumer Banking Group at Regions Bank. “Financial wellness is a top priority for Regions Bank, and that extends beyond our free Regions Next Step tools on regions.com and into our branch locations. Our teams work one-on-one with people to help them better understand their finances and provide solutions to reach their goals. It often begins with a simple conversation, and we encourage everyone, whether they are just starting to think about retirement, or whether retirement is fast approaching, to come talk to us about practical ways to build their savings and grow more confident in their financial futures.”

While this survey highlights a gap between what people want from retirement and how they are planning for it, there is good news in that free financial resources are available to help people plan for the future, no matter how much or how little they have saved so far.

Scott Peters, head of the Consumer Banking Group, Regions Bank

The recent Regions Next Step survey also suggests how often people set aside money may impact their confidence. Of those who are very or somewhat confident they are on track for reaching their retirement goals, 52% save for retirement in regular increments or time periods. In contrast, 23% of those who are only a little or not confident save regularly. In addition, 37% of those feeling only a little or not confident about their retirements report they are not currently saving at all.

Respondents shared financial obligations they see as obstacles to saving for retirement. Daily living expenses were cited as the biggest obstacle by almost half of those surveyed (45%). This was followed by housing payments (34%), medical debt (24%), saving for other goals, such as starting a family or buying a house (21%), and the financial impact of COVID-19 (20%).

Results also show there are knowledge gaps when it comes to retirement saving and planning. Around half of respondents do not feel knowledgeable about how to save for a comfortable retirement (47%), the difference between various saving types (51%), or making decisions about how their savings are invested (51%). Even those who are confident they will save enough still report knowledge gaps about how much to save (30%), the difference between various savings types (36%), and making decisions about investing their savings (31%).

Other key findings include:

- Fewer than one in three respondents surveyed (30%) save for retirement in regular increments or time periods.

- Many respondents think they should be saving more for retirement. While half of respondents (51%) are putting 10% or less of their gross income toward retirement savings, 41% of respondents think they should save 10-20% of their gross income.

- Those who are less confident they will have enough saved for retirement often save less: 46% save just 0-5% of their gross income.

- Among those who save for retirement, 30% of respondents use a 401k, and 27% have savings in a non-retirement account.

“Planning and saving for your retirement may not be as exciting as saving for a new car or planning for your next vacation; however, whether you’re nearing retirement or still decades away, it’s imperative to plan and invest in your future,” said Joye Hehn, Next Step financial education manager for Regions. “Everyone wants to be able to retire comfortably, and Regions is committed to providing free tools, resources and education to help people learn to grow their nest egg and create long-term financial security.”

Tuesday, Oct. 12 is National Savings Day, and Regions Bank is highlighting tools the company makes available for free year-round to help people build their savings, reduce their debts, and reach long-term goals. For people building their retirement savings.

Regions Next Step recommends the following:

- Plan for different stages of retirement. Financial needs and spending habits will likely fluctuate during retirement years. Check out this article for considerations when preparing finances.

- Determine how much to save. Understanding retirement needs is the first step in setting a retirement goal. This free Regions calculator can help identify how much to save for retirement.

- Build investment portfolios. Many people use investments to save for retirement. Register for an upcoming session of Regions’ webinar, “Maximize Your Personal Wealth,” to learn about investment strategies and ways to grow wealth.

- Factor in family financial needs. Decisions related to parenthood and employment can have an impact on retirement savings. Listen to this podcast to learn about potential impacts and how to work with an advisor on unique family financial needs.

For more guidance on planning and saving for retirement, visit Regions’ new financial wellness resource center on retirement, Regions.com/NextStepRetirement.

The Regions Next Step omnibus survey questions were part of a national online survey that took place between Aug. 9-11, 2021. The survey reached 1,258 U.S. adults. The results are weighted and are representative of all U.S. adults (18+).

Click for PDF

Click for PDF

About Regions Financial Corporation

Regions Financial Corporation (NYSE:RF), with $156 billion in assets, is a member of the S&P 500 Index and is one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services. Regions serves customers across the South, Midwest and Texas, and through its subsidiary, Regions Bank, operates more than 1,300 banking offices and approximately 2,000 ATMs. Regions Bank is an Equal Housing Lender and Member FDIC. Additional information about Regions and its full line of products and services can be found at www.regions.com.