After two years of a pandemic world, things are starting to get back to normal. And, unfortunately, a little too normal.

According to law enforcement officials across the spectrum, check fraud is reaching epidemic proportions again, thanks, in part, to the chaos of a COVID world and a boon of stimulus programs. The combination has created new opportunities for fraudsters to create mayhem.

“At Regions, your security is important to us, and we aim to keep you informed on the latest fraud trends and ways to protect your accounts,” said Jeff Taylor, head of commercial fraud forensics for Regions Bank. “According to recent reports, there is an uptick in fraudsters targeting bank accounts via check fraud using a variety of new variants of old methods.”

While there is no single reason for the increase in check fraud, there appears to be several factors driving the increase according to experts:

- Stimulus – The distribution of stimulus funds has ended, and fraudsters are returning to checks

- Social Media – The criminal underground network is creating a booming black market for stolen checks

- New Accounts – Fraudsters are opening new accounts and exploiting traditional deposit channels

- Scams – Fraudsters continue to attempt to deceive consumers and businesses who use checks as their payment method

- Mail Theft – Checks are being stolen from the mail, then washed, altered and deposited

- Aging Tech – Because check use is declining, there are hurdles to the modernization of the payment systems

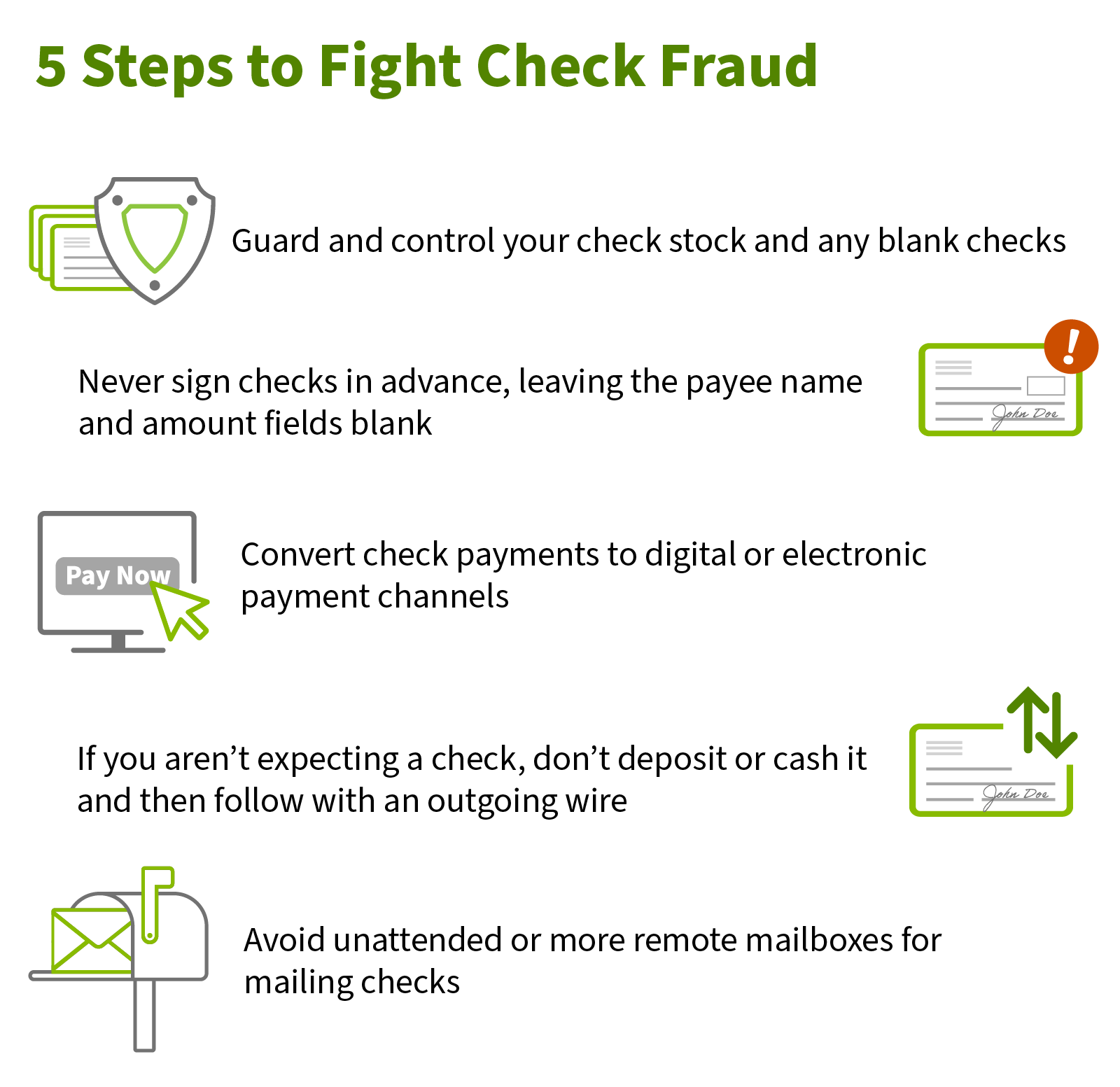

Even though the use of checks is decreasing, check fraud is not going away – in fact, it’s growing, making it even more important to follow these five simple guidelines:

- Guard and control your check stock and any blank checks

- Never sign checks in advance, leaving the payee name and amount fields blank

- Convert check payments to digital or electronic payment channels

- If you aren’t expecting a check, don’t deposit or cash it and then follow with an outgoing wire

- Avoid unattended or more remote mailboxes for mailing checks

Fortunately, there are solutions available to help combat these threats.

Randy Wilborn, Fraud Prevention Product manager at Regions, said there are logical reasons for the uptick in check fraud.

“That’s because check stock, as well as check printing equipment, is readily available to almost anyone,” Wilborn said. “Fraudsters can order this material online or from the local office supply store. Based on our experiences, it is easier for a fraudster to create a counterfeit check than it is to convince someone to click on phishing emails commonly used in various cyber schemes.”

If you are a Regions customer, you can talk to your Treasury Management Relationship Manager for more information or visit regions.com/stopfraud.

The information presented is general in nature and should not be considered, legal, accounting or tax advice. Regions reminds its customers that they should be vigilant about fraud and security and that they are responsible for taking action to protect their computer systems. Fraud prevention requires a continuous review of your policies and practices, as the threat evolves daily. There is no guarantee that all fraudulent transactions will be prevented or that related financial losses will not occur. Visit regions.com/STOPFRAUD or speak with your Banker for further information on how you can help prevent fraud